Budget 2020 Digital Services Tax 2%

From 1 April 2020, the UK government will introduce a new 2% Digital Services Tax. This is a tax on revenues from search engine, social media and online marketplace providers which derive value from UK users.

Big players such as Amazon, eBay, Google, Facebook, Twitter and the like will be targeted. I don’t think small medium enterprises, digital agencies and social media consultants need to worry just yet.

Who Pays Digital Services Tax?

Does your business make revenue from digital activities? If yes, are these revenues more than £500 million worldwide? How much of this revenue is derived from UK users? You will pay tax if its more than £25 million.

HMRC will not tax the first £25 million of digital revenues derived from UK users. They will tax businesses at 2% for anything above the £25 million threshold.

Online Advertsing

Advertising service providers like Google and Facebook get paid a fee every time someone consumes or clicks on an advert. The government will also tax this advertising revenue derived from UK users.

HMRC to Spend £8 Million to Implement

HMRC will spend up to £8 million on new IT systems and processes. Additional staff will monitor and administer the new tax.

Digital Services Tax Impact

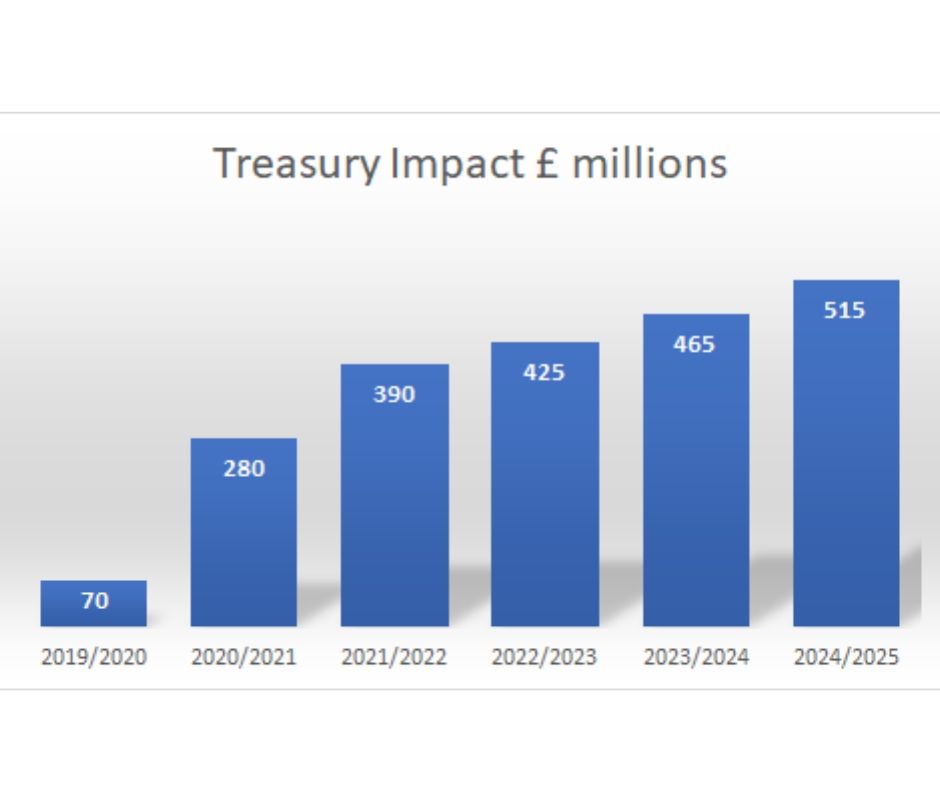

The Treasury expects to raise £280 million next year, rising to over £0.5 billion per year by 2024/2025.

Further Information

Here’s the original government policy document.